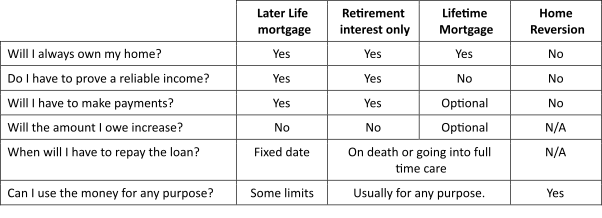

Retirement mortgage options

If you need to raise money and borrowing is the right way to do it, there might be alternatives to equity release.

Standard Mortgages for Later Life

Many lenders who offer standard mortgages have responded to the expectation that people will work well beyond the state retirement age. It is common to arrange a standard mortgage to age 75 and some lenders will consider applications up to age 90 or more. Most of the mortgage maybe available as interest only. A standard residential mortgage is likely to have a lower interest rate than an equity release option, which means that more of any payments you make will serve to pay off part of the loan.

However, you do have to show that you have enough income to meet the lender’s affordability requirements, usually from earnings. Also, the mortgage will have a fixed end date, so it is not a permanent option. A standard mortgage could be used to defer the time when an equity release option is needed.

Find out more about mortgages in later-life

Retirement Interest Only Mortgages

Retirement Interest Only, RIO for short, does not have an end date but requires the borrower to make monthly interest payments. The amount you can borrow depends on earnings which will come from pensions and investments. If you apply jointly, both of you must demonstrate that they have the income required should the other partner die or go into full time care.

The payments to a RIO are a commitment for life but the enforced payment of interest means that the amount of the debt will not increase. There is a risk that if you become unable to pay the monthly interest, you will have to find an alternative form of borrowing or the house will have to be sold.

Find out more about retirement interest-only mortgages

Our clients get...

Expert support and guidance

Friendly, dedicated advisers

Independent advice

Face-to-face or fully remote service